How Geothermal Works

Is Geothermal Right

For Your Home?

Benefits of Geothermal Heat Pumps

Energy Cost Savings - Up to 70%

Increased Comfort / Improved Dehumidification

Less Noise

Smaller Carbon Footprint

No Outdoor Equipment

Longer Lifespan

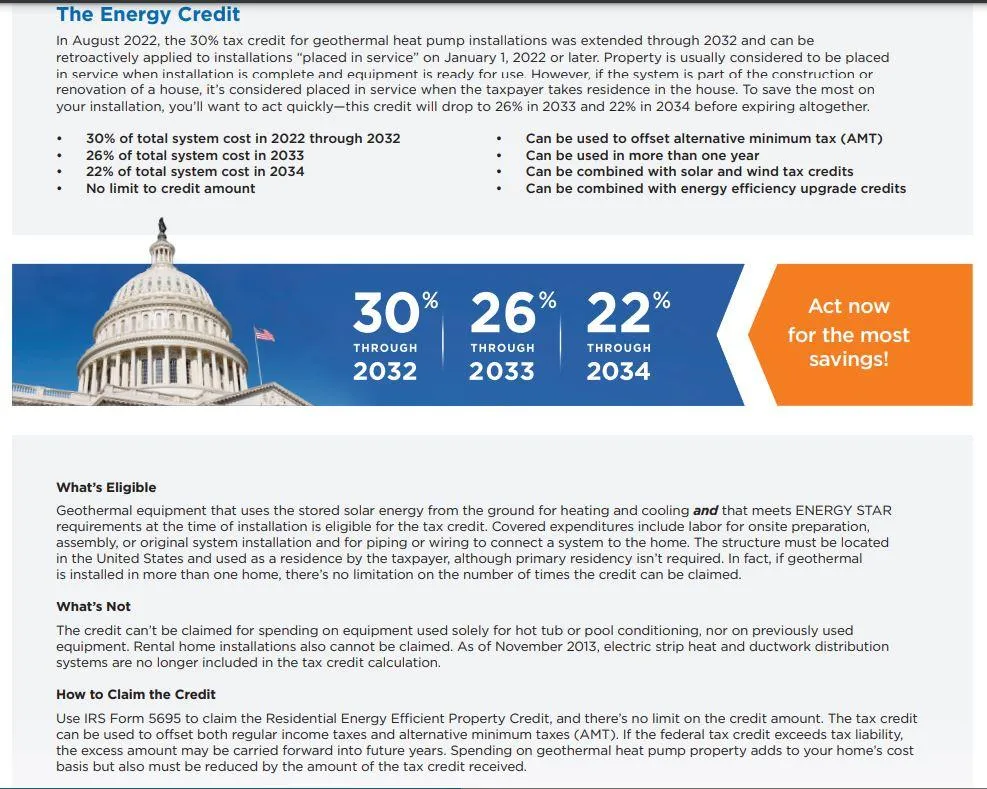

30% Federal Tax Credit

Why Should You Invest in Geothermal?

Simply put, geothermal systems are the most comfortable and energy-efficient way to heat and cool your home. You will save energy and slash electric bills while cutting greenhouse gas emissions. You will no longer have a noisy outside unit outside your home. All equipment is located inside out of mother natures wrath. Most WaterFurnace units will also heat 60% to 70% of your hot water for a fraction of the cost of your water heater. Geothermal units also have a life span of 1.5 - 2X that of a traditional system.

Professional Unit Installs and Service

With over 25 years of experience in servicing and installing geothermal equipment, we are your trusted source for all things Geo. We service and install units in both Georgia and parts of South Carolina.

Professional Loop Installs and Repair

Whether you need a new loop installed, or an existing loop repaired, Southern Geothermal is here to help!

We work directly with homeowners or with other HVAC Contractors. We are willing to tackle the loop and let you focus on the equipment install.

Tax Incentives

30% Tax Credit on Residential Installs

30% Tax Credit on Most Commercial Installs

Tax Incentives

Interested in Geothermal? Give us Some More Info

About Your Property

(Only takes 15 seconds!)